Stop relying on aggregated averages to benchmark commercial rates.

See actual contracted rates by NPI, Tax ID, and CPT code—sourced from public payer filings under the Transparency in Coverage Act.

Healthcare finance teams who've made the switch from traditional benchmarking

FAIR Health aggregates payer-submitted data. We surface actual negotiated rates.

PayerPrice data is sourced from federally mandated payer disclosures, showing true in-network allowables.

Voluntary payer submissions drive FAIR Health's benchmarks

Because the data reflects payer-side contributions, it may not represent the rates providers actually negotiate and receive.

Averages can obscure the full picture of provider reimbursement

Negotiations happen at the code and contract level. You need benchmarks that mirror that. We show exact rates by NPI, plan, and procedure.

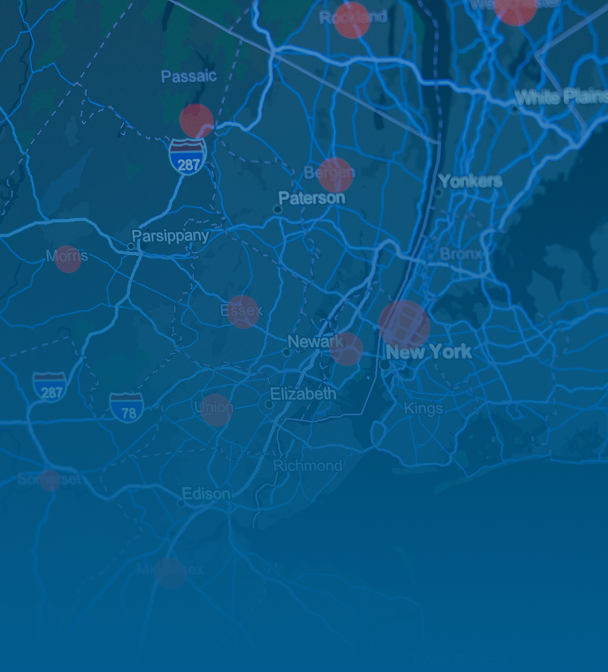

Segmenting by zip-code limits market visibility

Many benchmarking tools restrict access by geography. PayerPrice provides full-state and national access at a flat, transparent rate.

PayerPrice gives you access to every negotiated rate, not just averages.

Access in-network fee schedules, for every payer, provider and procedure – so you can benchmark with confidence.

Here's what you can do with PayerPrice

Renegotiate your managed care contracts

Benchmark your current rates against market averages to identify opportunities for rate optimization.

Prospect for new business using fee schedules

Access every provider's negotiated rates for every billing code in your market to inform your prospecting strategies.

Integrate real-time payer data into your workflows

Automatically keep fee schedules up-to-date without adding yet another log-in to your insurance systems. Connect via API or SQL.

PayerPrice shows you the exact negotiated rates that insurers publish under federal transparency rules.

We display the raw data directly from insurers' files, giving you the same information they make public. Learn more about Price Transparency.

Success Stories

"PayerPrice shows us what our competitors are actually getting paid. It's completely changed how we approach payer negotiations."

"We replaced our expensive benchmarking tool with PayerPrice and immediately saw ROI. Having provider-specific data gave us the leverage we needed to negotiate fair rates."

"We've built our entire payer strategy on PayerPrice."

Granular, Provider-Level Contract Intelligence

Built for providers and health systems—not payers. PayerPrice surfaces real rates by provider, plan, and code.

Benchmark rates at the NPI and Code level

Compare your reimbursement against any provider by NPI, Tax ID, payer, and procedure code. Spot gaps by MS-DRG, CPT, or APC.

- ✓Exact negotiated rates by NPI and TIN

- ✓Competitor-by-competitor comparisons

- ✓Code-level pricing across service lines

- ✓Up-to-date market rate benchmarks

Actual negotiated rates from regulatory filings, not averages

Unlike payer-sourced datasets, PayerPrice uses Transparency in Coverage files to show actual contracted rates. No bias. No extrapolation.

- ✓Sourced from Transparency in Coverage Act

- ✓No biased aggregates or estimates

- ✓Fully auditable contract figures

- ✓Updated every month

Statewide access for a flat price

Avoid zip-code-based fees and geographic restrictions. Get full statewide and national visibility with simple, flat-rate pricing.

- ✓One price for unlimited access

- ✓No zip-code paywalls or tiers

- ✓Download-ready CSVs and exports

- ✓Support for API integrations

Comparing FAIR Health to Provider-Level Benchmarking

Key differences between aggregated estimates and provider-level rate intelligence.

FAIR Health relies on payer-submitted aggregate data, averaged by zip code. PayerPrice uses actual negotiated rates from federally mandated disclosures—broken down by provider, plan, and code.

PayerPrice offers multiple options to fit your needs, including a flat rate for statewide access, a tiered pricing model for more granular access, and a free trial for a limited reports.

Our data is sourced from required payer filings, not voluntary submissions. It's comprehensive, current, and reflects the rates payers actually agree to pay.

Yes. PayerPrice shows contracted rates by NPI and TIN, so you can see what specific providers negotiated with specific plans at the code level.

Yes. We offer full API and SQL access to integrate with Epic, Cerner, MEDITECH, and other revenue systems. Export or automate as needed.

Most customers identify negotiation opportunities within days. There's no complex setup and users typically pull benchmarks within minutes of onboarding.

Aggregates don't win negotiations. Actual rates do.

Traditional benchmarking tools offer incomplete data. We show what providers are actually getting paid—so you can negotiate from a position of clarity.